The Impact of Switching Banks

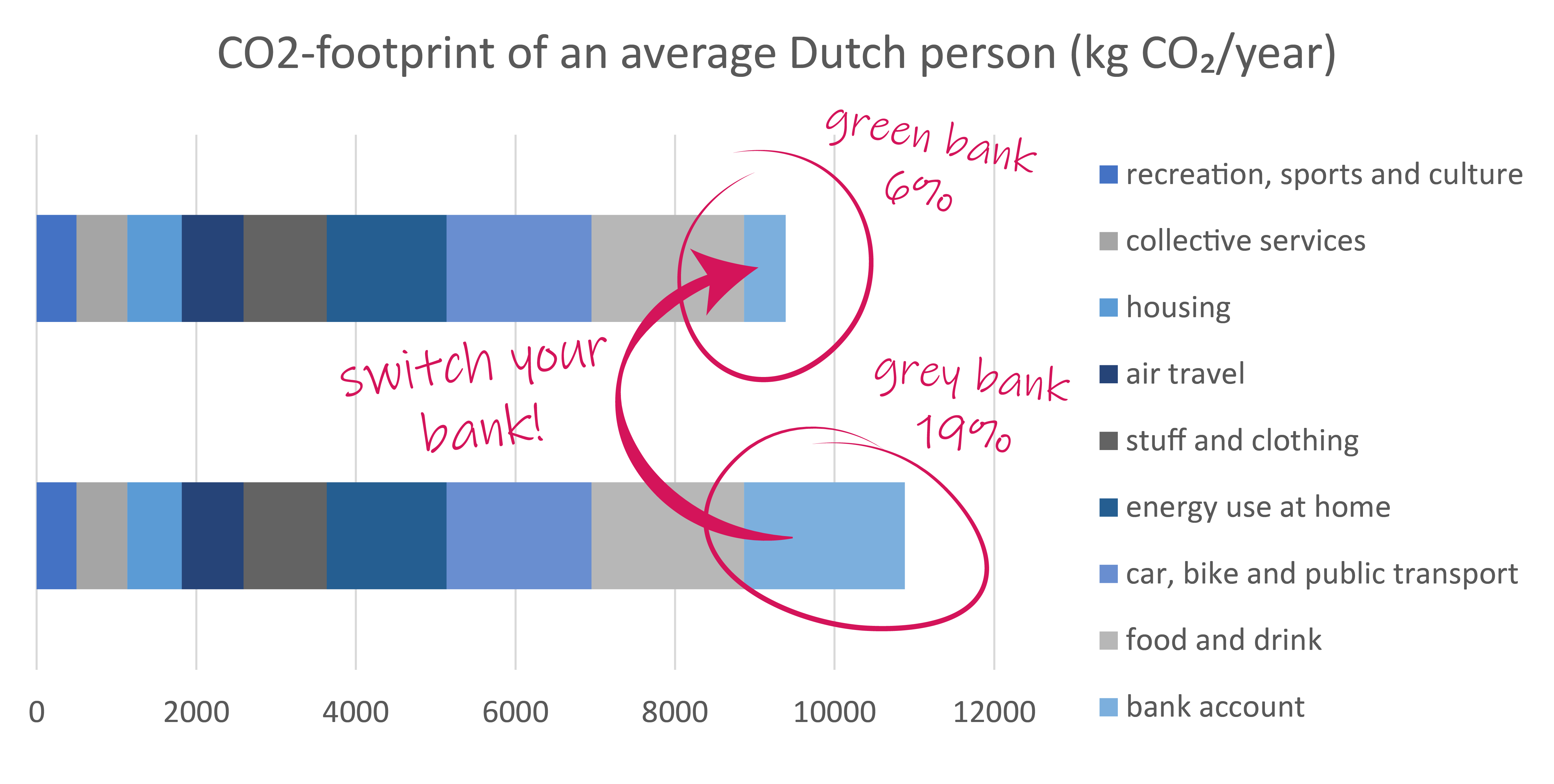

If you’re someone who cares about the environment, you might already be taking steps to reduce your carbon footprint. Maybe you’ve switched to energy-efficient light bulbs or you are more conscious of your water usage. But there’s another way you can make a big impact without even changing your daily habits: switching your bank.

You can download the spreadsheet with assumptions used for the thumbnail here.

You can download the spreadsheet with assumptions used for the thumbnail here.

How banks use your money

When you put money on your savings account, you might assume that the bank is simply holding onto your cash until you need it again. The truth however, is that your money is being put to work, invested in various projects and companies that the bank hopes will earn a profit1. And as it turns out, where you choose to save your money can have a big impact on the world around you.

Some banks prioritise making as much money as possible, regardless of the impact their investments may have on the environment or society as a whole. Other banks take a more thoughtful approach, carefully choosing where to invest their funds, also based on their values and moral standards.

By moving your savings from one bank to another, you’re essentially casting a vote for the types of investments you support. This means that by choosing a sustainable bank, you can help support industries that prioritize things like renewable energy and social justice, while avoiding those that contribute to things like climate change or inequality.

So far, it has been difficult to know just how much of an impact your choice of bank can really have. But a recent report2 has finally given us some concrete data that we can use to better understand the power of our savings.

How big is the impact?

Before I get to number-crunching, I would like to point out that the impact of switching banks is actually two-fold, and that the real impact of this simple change is much larger than what I’m about to show.

The first impact (and the one I will focus on here) is rather direct. Each dollar invested by a bank has a CO2-footprint. By comparing the CO2-footprint per dollar invested for two different banks, we can calculate the total emissions that we avoid by making the switch.

The second impact is less direct. Investments shape our society. They basically describe what we want to see in the future. Investing in green technologies paves the way for a green society, while investing in fossil-based industries means that we’re keeping things as they were for another 30+ years.

Naturally, this impact is impossible to quantify, but should definitely be considered in addition to the calculation presented below.

The direct impact of switching banks

When a bank invests in a company, the emissions of the investment correspond to the emissions of that company. For the data that we will use, three types of emissions are taken into account:

Scope 1 emissions refer to the direct emissions from a company’s own operations, such as the emissions from their own vehicles or their own factories. Scope 2 emissions are the indirect emissions from the production of the energy used by the company, such as the emissions from generating the electricity that powers their buildings or machinery. Scope 3 emissions are the indirect emissions that occur throughout a company’s entire supply chain, such as the emissions from producing the materials used in their products, the emissions from transporting those products, and the emissions from the use and disposal of those products by customers.

Let’s consider a green and a grey3 bank. The green bank holds 8.23 billion euros worth of investments, and the grey bank 69.90 billion. By dividing the emissions of these investments by their value, we can calculate the CO2-intensity of each euro invested (kg CO2eq/€).

| CO2-intensity (kg CO2eq/€) | grey bank | green bank |

|---|---|---|

| scope 1 | 0.177 | 0.015 |

| scope 2 | 0.047 | 0.006 |

| scope 3 | 0.781 | 0.240 |

| total | 1.005 | 0.261 |

Using the total CO2-intensity we can see what the CO2eq change would be if we would switch from the grey to the green bank, for each euro in our account4: 1.005-0.261=0.744. So, if you have €1,000 on your savings, account, the arguable impact of switching banks is 744kg of CO2eq.

Let’s now put this into perspective. Imagine you have not €1,000, but €1,344 in your account. Switching banks means you reduce your indirect footprint by the convenient amount of 1 tonne (1,000 kg) CO2eq. This is similar to driving a car for half a year, 2.6 economy flights from Amsterdam to Rome, or 72 train-trips from Amsterdam to Paris. To offset this CO2, 50 trees would have to be growing for a year5.

More on the behavioural side, 1 tonne of CO2 emissions is the equivalent of the CO2 produced for the consumption of roughly 6.5 kg of beef6, which is more than a third of the annual consumption of a typical Dutch person (15.1kg7).

Now, for this calculation I make some assumptions, such as that the deposits remains at the bank for the duration of the investment, and that investments are instantaneously and literally replaced. Naturally, this doesn’t happen in reality, but overall, it gives a viable proxy for the order of magnitude of the impact that your decision could have.

How much effort does it take?

Thanks to the wonderful initiative of the ‘overstapservice’ by the collective of banks in the Netherlands, switching banks remains a hassle-free process that doesn’t require any effort at all (see informatie overstapservice for details).

By simply informing your new bank that you’re opening an account, they will take care of the rest—including automatically redirecting incoming payments or payment requests to your new account, and notifying anyone who sends or receives money from your old account about the change in your account number.

Which bank should I choose?

This depends on what you consider to be most important. Some banks are pioneers in the domain of environmental sustainability while others focus more on social issues or developments in the global south. To see which bank best suits your values, check out the Eerlijke Bankwijzer! There, you can also see how your pension and insurance funds perform on various topics.

I hope this short article has given you a better understanding of the impact of switching banks, and hopefully it challenges you to think about making a change.

DISCLAIMER: Please note that the calculations and reasoning presented in the text are oversimplifications of reality. They are intended to make the story more understandable for a general audience, and should not be taken as precise or comprehensive analyses of the topics discussed.

PERSONAL NOTE: The financial system is impossibly complex and often it’s hard to see what the effects of certain decisions will be. For a long time, I’ve struggled with the issue of switching banks. While I knew that it had an impact, how this impact (together with the little effort that is required) compared to other things (e.g. buying solar panels, becoming vegetarian) remained a mystery. While this calculation isn’t perfect, it at least helps to put things into perspective for myself and others, and hopefully encourage positive change.

Footnotes

This is not really how it works, in fact, a bank ‘creates money’ when they issue a loan. For the argument I’m making in this article however, this doesn’t really matter. If you would like to find out how it works exactly, you can check out (this article from the Bank of England)) ↩

See “Dutch financial sector financed emissions” (view official report) ↩

For the grey bank, we take the data for ING from the report. For the green bank, we take ASR (which is an insurance company) due to the absence of any green banks in the study’s analysis. ↩

Actually a bank does not invest €1 for each €1 it raises via deposit because it must maintain a specified percentage of its deposits as reserve for people to withdraw. This buffer is not considered in the calculation but is generally very low. This reserve ratio in the Netherlands is only 1% view source. ↩

Examples taken from The Climate Neutral Group ↩

For more equivalent calculations see CO2 Everything ↩